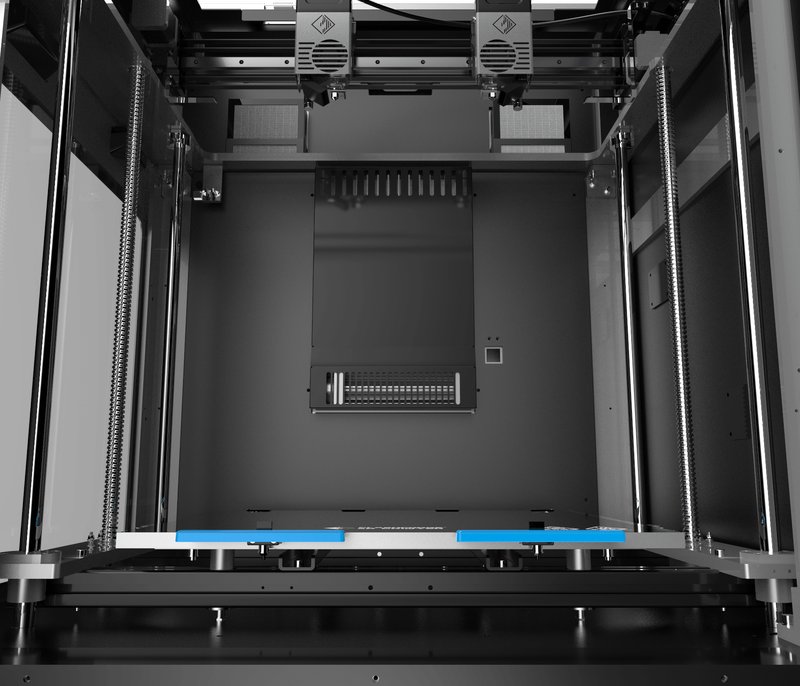

Der Flashforge Creator 4 ist ein professioneller FFF-3D-Drucker für den kommerziellen Einsatz, der Funktionalität, Flexibilität, Produktivität und Spitzenleistung bei der Herstellung von Endverbrauchsteilen und Funktionsprototypen vereint. Die Maschine ist mit einer vollständig geschlossenen Kammer ausgestattet, die dank des thermisch gesteuerten Systems eine konstante Temperatur von bis zu 65 °C halten kann. Darüber hinaus erfüllt das riesige Bauvolumen von 400 x 350 x 500 mm (15,7 x 13,8 x 19,7 Zoll) die meisten Druckanforderungen der Hersteller.

Das Gerät bietet zahlreiche fortschrittliche Funktionen wie das intelligente Filament-Management-System, Filament-Auslauferkennung, automatische Bettnivellierung, Wiederaufnahme des Druckvorgangs nach einem Stromausfall, effektive Wärmeableitung, zwei Filamentspulenhalter (1 und 2 kg) und HEPA13-Luftfilter.

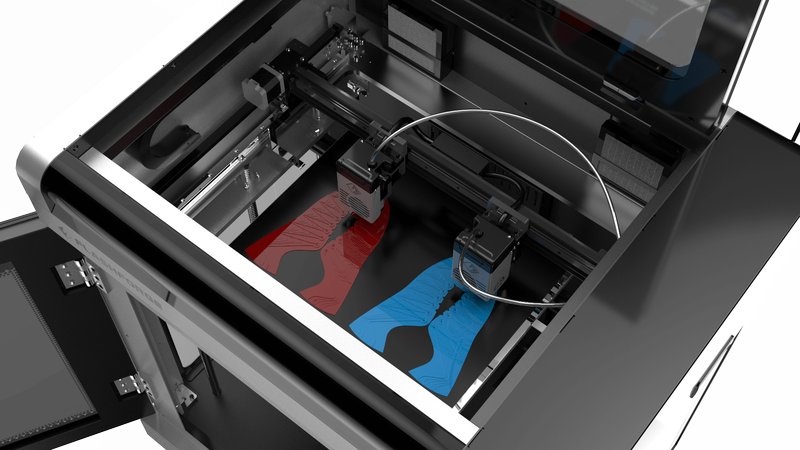

Der größte Vorteil des Flashforge Creator 4 ist jedoch das IIDEX (Interchangeable Independent Dual Extruder System). Dank der beiden Extruder, die sich unabhängig voneinander entlang der X-Achse bewegen können, unterstützt das Gerät den Druck im Duplikations- und Spiegelungsmodus und verdoppelt so das Produktionsvolumen. Eine weitere nützliche Funktion des IDEX-Systems ist der Zweifarb- oder Zweimaterialdruck, einschließlich des Aufbaus löslicher Stützstrukturen.

Der Flashforge Creator 4 ist in zwei Versionen erhältlich, dem Creator 4-A und dem Creator 4-S, die sich in der Art der Extruder unterscheiden, mit denen der Drucker ausgestattet ist. Das Modell Creator 4-A ist mit zwei 320 °C-Extrudern-HT ausgestattet, die mit einer breiten Palette an technischen Polymeren kompatibel sind.

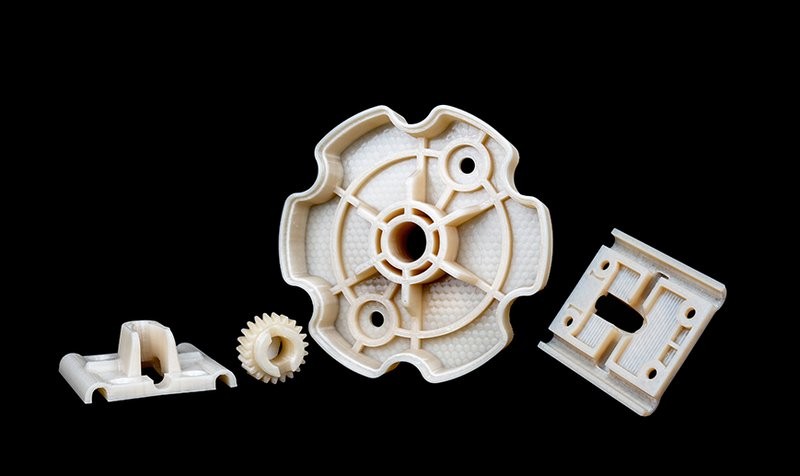

Das Modell Creator 4 eignet sich perfekt für den professionellen Einsatz in vielen Bereichen, z. B. für das Design von Industrieteilen, den Vorrichtungsbau in der Produktion, die künstlerische Architektur und vieles mehr.

Der Flashforge Creator 4 ist ein FFF-3D-Drucker, der Schichten mit einer Dicke von 15 Mikrometern drucken kann. Mit ihm können Sie Teile mit glatten Außenflächen, komplexer Geometrie und detaillierter Zusammensetzung herstellen.

Dank der linearen Schienen bietet das Gerät eine höhere Bewegungsstabilität und damit eine bessere Druckpräzision. Das brandneue S-Typ-Bewegungssteuerungssystem sorgt für einen sanfteren Start und Stopp, eine genaue Positionierung der Düse und außergewöhnliche Details.

Darüber hinaus ermöglicht das Filament-Management-System die Einstellung verschiedener Vorwärmtemperaturen für bestimmte Materialien. Das sorgt für eine höhere Erfolgsquote beim Drucken.

Der Flashforge Creator 4-A verwendet 1,75 mm Filament, so dass Sie unabhängig vom Hersteller eine große Auswahl an Verbrauchsmaterialien haben.

Die Version Creator 4-A ist mit zwei Extrudern-HT mit einer Höchsttemperatur von 320 °C ausgestattet und unterstützt den Druck mit technischen Filamenten wie PLA, PETG, PC-ABS, PAHT, ABS, ASA, PP, PA und PC.

Zusätzlich können Sie einen optionalen Extruder-HS oder Extruder-F kaufen, um die Palette der kompatiblen Kunststoffe mit Hochtemperatur- oder flexiblen Filamenten zu erweitern.

Die riesige Druckfläche von 15,7 x 13,8 x 19,7 Zoll (400 x 350 x 500 mm) ermöglicht es Ihnen, ein einziges großes Modell zu drucken oder gleichzeitig mehrere kleinere Modelle herzustellen.

Der Drucker ist mit einem 7-Zoll-Farb-Touchscreen mit erhöhter Empfindlichkeit ausgestattet, der eine einfach zu bedienende und übersichtliche Benutzeroberfläche bietet.

Zu den Anschlussmöglichkeiten gehören USB, Ethernet und Wi-Fi, was einen mühelosen Standalone-Betrieb ermöglicht. Der Creator 4 verfügt außerdem über eine integrierte HD-Kamera für die Fernüberwachung.

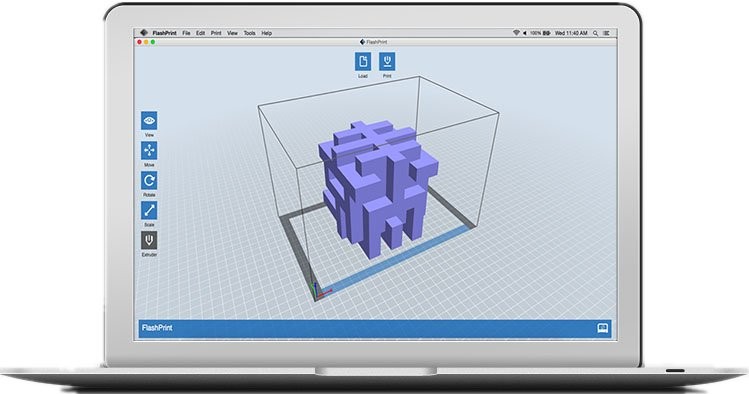

Das Gerät verwendet den firmeneigenen FlashPrint-Slicer. Er arbeitet mit den Dateiformaten 3MF, STL, OBJ, FPP, BMP, PNG und JPEG. Die Druckersoftware läuft auf Windows-, macOS- und Linux-Betriebssystemen.

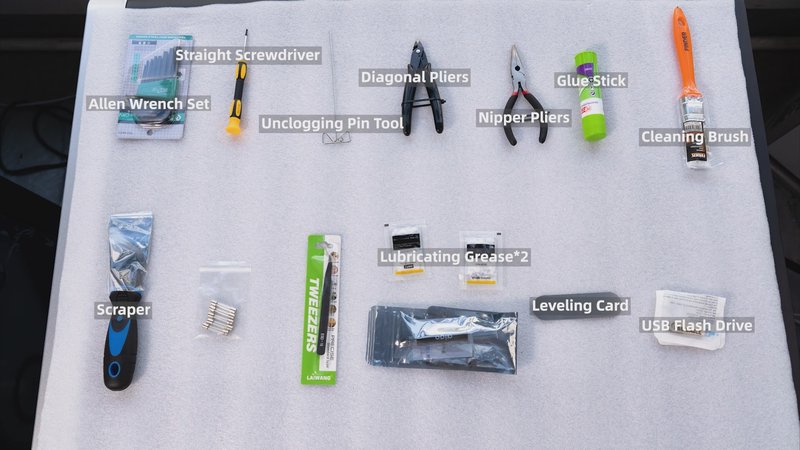

Bei einigen Artikeln kann sich der Packungsinhalt ändern. Falls Sie Fragen haben, kontaktieren Sie uns bitte.

Der Flashforge Creator 4 ist in einem grau-schwarzen Farbschema erhältlich. Sein stilvolles Aussehen verschönert jede Werkstatt oder jedes Maker-Labor.

Die Abmessungen des Druckers betragen 33,1 x 26,6 x 39,4 Zoll (840 x 675 x 1000 mm). Er wiegt 90 kg (198,42 lb). Die Filamentspulen sind in einer eingebauten Filamentkartusche an der Seite des Druckers untergebracht.

Um den aktuellen Preis des Flashforge Creator 4-A 3D-Druckers zu erfahren, klicken Sie auf den Button "Angebot anfordern" und füllen Sie das Formular aus. Wir werden Sie so schnell wie möglich kontaktieren und Ihnen alle Details zukommen lassen.

Update your browser to view this website correctly. Update my browser now